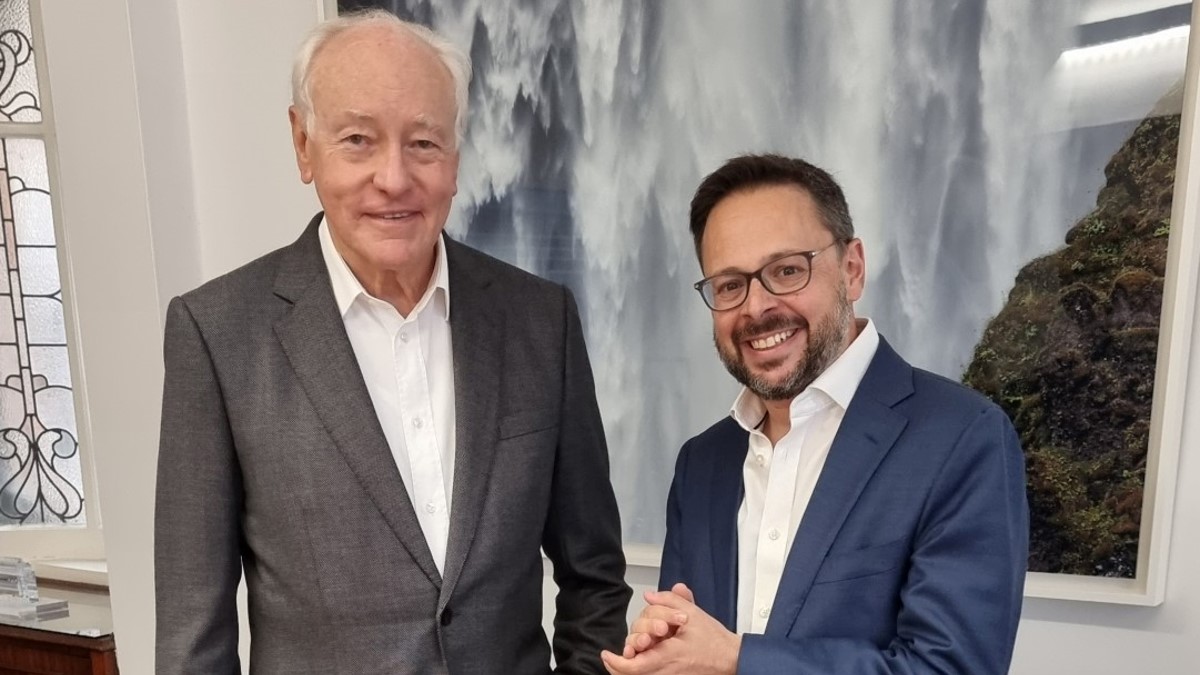

Private debt investor Fintex Capital has named business veteran Tony Trahar as strategic adviser.

Fintex Capital said that Trahar will play a crucial role in the continued expansion and governance of the firm, as it enters its next phase of growth.

Trahar has a 40-year career in business, including seven years as chief executive of FTSE 100 miner Anglo American, during which time he oversaw $15bn of acquisitions and a $19bn take private of De Beers Diamonds with the Oppenheimer family and Botswana’s government.

Since leaving Anglo American, he has held several advisory roles including Barclays Natural Resource Investments, Macquarie Bank and Vision Blue Resources.

“I am pleased to deepen my involvement with Fintex Capital,” said Traher. “I have been impressed with Rob and his team and their ability to consistently deliver value to borrowers and outperformance to investors. As banks continue to retrench and act with reluctance, current markets offer highly attractive opportunities for assertive-yet-cautious lenders like Fintex. I look forward to providing strategic input with a focus on growth and governance.”

“I am delighted that Tony now joins us as strategic adviser,” said Robert Stafler, co-founder and chief executive of Fintex Capital. “The Trahar family office has been a long-term investor in our firm and in our discretionary funds since 2018, so we have informally benefitted from his wise counsel for several years. It gives me great pleasure to now welcome him formally to our advisory board. His commitment to operational excellence and governance as well as his deep experience will bring strategic value to the development and growth of our business.”

…read more on p2pfinancenews.co.uk…

Contact our team

hello@fintexcap.com