Fintex Capital’s £10M Financing Boost for Forest Micromobility

- Fintex’s first deal of 2025 follows a record-breaking 2024

- Funding fuels the expansion of Forest’s operations in London

- Last year, Forest achieved its 1st full year of profitability, reaching 1.2m trips pcm

London, 22 January 2025 – Fintex Capital, the innovative private debt firm, started the year by extending up to £10 million in Asset-backed Finance to Forest, the urban micromobility pioneer. This investment enables Forest to expand its London operations and introduce 3 new e-bike types to support Forest’s growing customer base.

Strengthening Forest’s Expansion with Upgraded Forest App

Forest simultaneously announced a £3 million equity investment from new and existing investors. This will finance upgrades to the Forest App as well as further advancements in parking compliance and user behaviour technology.

Forest: A Leader in Sustainable Urban Mobility

Since entering London’s bike-share market in 2020 with its innovative offer of ‘10 minutes per day for free’, Forest has redefined urban mobility with zero-emission operations. Forest presently completes over 1.2 million trips per month and, in 2024, delivered its first full year of profitability. The Fintex investment marks another strong endorsement of Forest’s approach to sustainable urban transport.

Driving Impactful Investments Through Fintex Private Debt

The Asset-backed Financing was funded by the firm’s award-winning flagship UK fund, Fintex Private Debt, and led by the firm’s Chief Investment Officer, Sophie Batoua. It underscores the firm’s commitment to impactful investments that support sustainable innovators. The investment follows a highly successful 2024 in which Fintex doubled its UK Assets under Management, while continuing to deliver double-digit net returns.

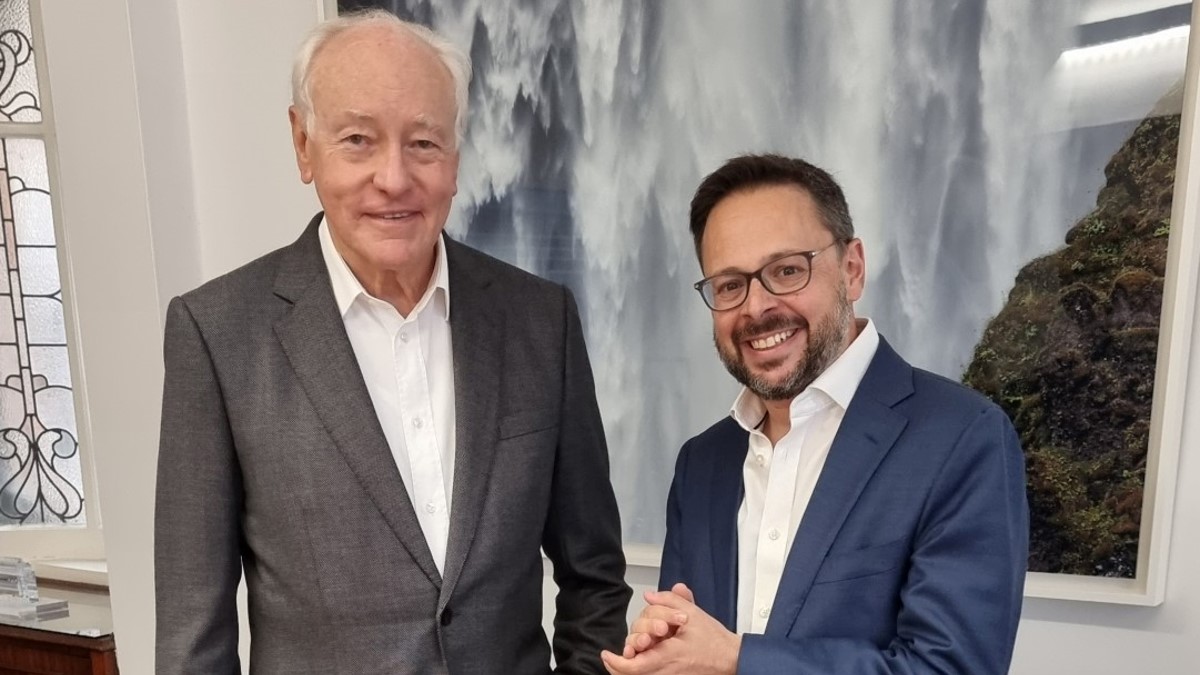

Robert Stafler, Fintex Capital CEO & Founder, said: “We are thrilled to support Forest, London’s affordable and eco-friendly micromobility platform. In times when cities urgently need sustainable transport solutions, Forest’s proven efficiency makes it a standout partner for Fintex. We look forward to seeing Forest solidify its strong position in London whilst also unlocking new cities.”

Diversifying Forest’s Fleet for Accessible and Affordable Urban Transport

Agustin Guilisasti, Forest CEO & Founder, added: “The Fintex investment allows us to accelerate our growth and supports us in increasing bike sharing in a responsible way. It ensures that our bikes and our users promote everyone’s enjoyment and use of city infrastructure. We are also excited to widen access to our scheme and diversify our fleet. We remain committed to long-term partnerships with cities and public transport providers to realise our vision of affordable, sustainable mobility for all, and with this financing, we are making excellent progress towards that goal.”

– ENDS –

About Forest (www.forest.me)

Forest is London’s affordable and environmentally sustainable micromobility platform. Forest was founded by Agustin Guilisasti (ex-Cabify) alongside co-founders Caroline Seton and Michael Stewart. The Company already completes more than 1.2 million rides per month. Its operations are ‘zero emission’, since every bike in its fleet, as well as all service vehicles, are certified to be powered only by renewable energy. Forest is one of the world’s first micro-mobility companies to have B Corp accreditation and the only micro-mobility company to have achieved Verra validation.

About Fintex Capital (www.fintexcap.com)

Fintex Capital is an innovative investment firm specialising in private debt. Since its inception, the firm has provided £400 million in private capital to borrowers across Specialty Finance, Real Estate Debt and Asset Backed Finance. Fintex is best known for providing senior and mezzanine debt financing to lending businesses in the UK and Continental Europe. It also provides direct lending to asset-backed businesses and asset owners. The firm manages discretionary investment funds, as well as segregated managed accounts for various institutions. Fintex Capital has received numerous prestigious awards, including the the Alternative Credit Investor Award for “Performance of the Year 2024” (among fund managers below £1 billion).

Media enquiries

For further information, please contact:

Alex Berwin, Forest: Alex.Berwin@humanforest.co.uk

Contact our team

hello@fintexcap.com